Georgia legislators have initiated a comprehensive review of the state's tax incentives, sparking debate about their effectiveness and impact on the state's overall financial health. While some lawmakers aim to reduce tax breaks to pave the way for lower income tax rates, others emphasize their importance in attracting businesses and fostering economic growth.

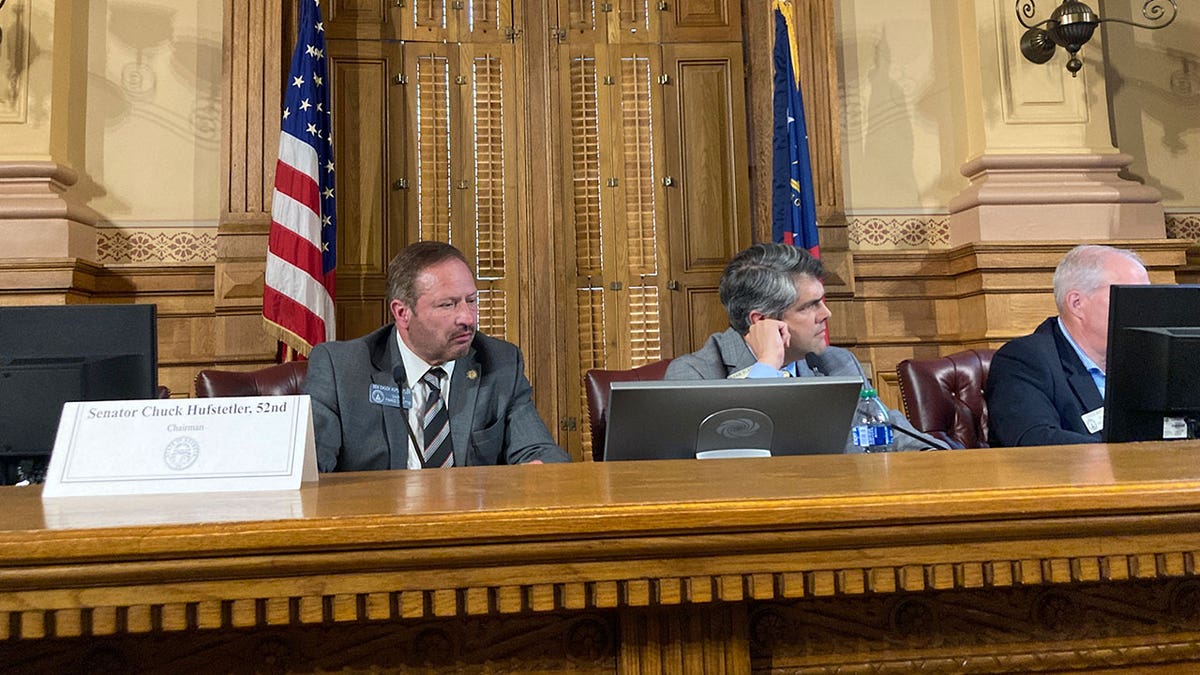

The Joint Tax Credit Review Panel, a long-awaited initiative spearheaded by Senate Finance Committee Chairman Chuck Hufstetler, a Republican known for his occasional skepticism of tax breaks, is at the center of this review. The panel's findings could shape legislation in the coming year.

Lieutenant Governor Burt Jones, also a Republican, supports the review, hoping that streamlining tax incentives could contribute to his goal of reducing or eliminating the state income tax. Jones believes that regularly evaluating and adjusting tax policies is crucial for providing tax relief to both businesses and families.

However, nearly every tax break, from large corporate incentives to smaller provisions like the sales tax exemption for crab bait used by commercial fishermen, has its proponents. The review panel's meeting room was filled with lobbyists representing various interests, highlighting the diverse perspectives on the issue.

Expert opinions on tax incentives also vary. State economist Jeffrey Dorfman advocated for targeted and limited use of tax credits, suggesting that incentives should be strategically employed to attract key industries but not necessarily extended to suppliers or subsequent investments. He argued that the state should recoup the initial investment through subsequent gains.

In contrast, Andrew Capezutto, chief administrative officer and general counsel of the Georgia Department of Economic Development, emphasized the importance of a stable and predictable incentive system for attracting businesses. He argued that Georgia's incentives are not overly generous compared to neighboring states and that the state often faces challenges in competing for business investments.

A central challenge in evaluating tax incentives is determining whether businesses would have invested even without the tax benefits. Robert Buschman of Georgia State University's Fiscal Research Center highlighted this difficulty, noting the complexity of isolating the impact of tax incentives on business decisions.

Initial evaluations of eight business tax incentives suggest that the sales tax exemption for computer equipment and the research and development tax credit are the least effective in influencing business investment. Evaluators estimated that only a small fraction of the research and development tax credit claims were truly motivated by the credit itself.

Despite these findings, it remains uncertain whether any incentives will be eliminated. Senate Appropriations Committee Chairman Blake Tillery stated that there isn't a specific agenda to eliminate any particular tax credit. Meanwhile, Chairman Hufstetler expressed a desire for more independent evaluation of data reported by state agencies, including the Department of Economic Development, to ensure objectivity.

Hufstetler also advocated for a system where lawmakers would review vetted projections before approving new incentives, rather than relying solely on projections provided by the companies seeking the benefits.

Comments(0)

Top Comments