A recent report from the Small Business Administration Office of the Inspector General (OIG) has ignited controversy, revealing that over $200 billion in COVID-19 relief loans may have been fraudulently disbursed. This figure is nearly double previous estimates, raising serious concerns about oversight and accountability within the SBA.

The OIG report identified 4.5 million potentially fraudulent loans and grants across pandemic relief programs. It criticizes the SBA for lacking a robust internal control system to prevent fraudsters from accessing funds intended for legitimate businesses struggling during the pandemic.

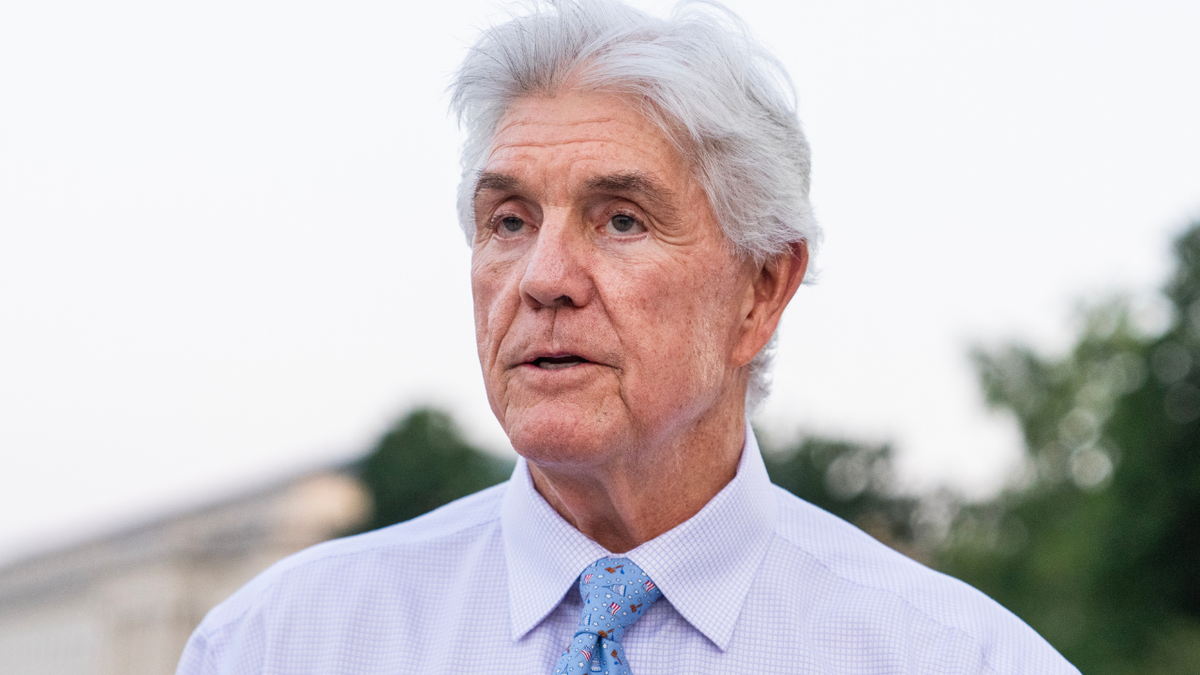

Rep. Roger Williams (R-TX) expressed alarm at the report's findings, stating that it reveals a significant level of criminal activity and a failure by the SBA to implement adequate safeguards. He highlighted that approximately one in five disbursed loans are now flagged as potentially fraudulent. Williams anticipates questioning the Inspector General directly in July to understand the systemic failures, explore solutions, and determine how to recover misappropriated taxpayer funds.

The SBA, however, contests the OIG's findings. SBA management argues that the report's methodology contains flaws that significantly inflate the estimated fraud. The OIG maintains confidence in its assessment.

SBA Administrator Isabella Casillas Guzman emphasized the positive impact of pandemic relief programs, crediting them with fueling economic recovery, saving businesses, and creating jobs. An SBA spokesperson, Han Nguyen, strongly disagreed with the OIG's $200 billion fraud estimate, attributing a large portion of any potential fraud to the initial rush to distribute funds quickly, which necessitated a reduction in certain anti-fraud measures. Nguyen also asserted that the OIG's report overlooks or downplays loan repayment data that would mitigate the perceived extent of fraud.

Comments(0)

Top Comments